It is challenging to get a credible and widely accepted estimate of the size of the "business translation" market. The researchers who generate the market forecasts focus heavily on publicly available, or voluntary survey data provided by Language Service Providers (LSPs) in the most visible part of the translation market, yet they seem to come up with somewhat different market sizing estimates. One is often left wondering what they are counting, and where and how they are getting the supporting data. The variations in the market estimates are quite different, as we see below.

- The Slator 2020 Language Industry Market Report provides a view of the global language services and technology industry, which, according to Slator, grew to a USD 24.2 billion market in 2019.

- According to The Nimdzi 100 annual report, the language services industry will reach USD 53.6 billion in 2019 and is projected to reach USD 70 billion by 2023.

- The market for outsourced language services and supporting technology grew 6.62% to USD 49.60 billion from 2018 to 2019, according to market research firm CSA Research.

There is evidence to suggest that there may actually be several translation markets, and the underlying assumption by the market researchers about a single market may be the reason they are all perhaps only presenting a partial and incomplete picture. Chris Durban, who was instrumental and helpful in my research for this post, characterizes the overall translation market as consisting of three different markets. The translation market can be presented as a continuum, where some overlap may be possible: Bulk > Added Value > Premium.

Kevin describes, "[….] a very long continuum [in the overall market] that encompasses all market segments, with raw, free MT at one end, and $25,000 tagline translations of 3 words [or low word volume high-impact communications] at the other."

Many (especially those firmly entrenched in the bulk localization translation market) immediately say that premium simply means that the word rate is higher. However, we all understand that a higher price without discernible higher value delivered is generally an unsustainable business proposition. This post attempts to delineate the differences more clearly, as I have observed that the premium market is often dismissed as a myth. I am not saying that premium work is always more valuable than bulk translation, and the "bulk versus premium" phrasing can often be problematic. Both kinds of translation work are necessary and essential for any enterprise with critical global initiatives. Yet while both are necessary, we should also acknowledge that expertise, knowledge, compensation, and other attributes are different.

As Kevin states: "It's far more accurate to characterize the [translation work] continuum in terms of gradual and consistent gradations of shade rather than in terms of clear differentiating boundary lines. The "premium versus bulk" dichotomy is a form of shorthand only. That also applies to price and quality, since the correlation between the two is not always linear. The premium sector includes commercial segments that are fiercely guarded and (often) shrouded in secrecy to prevent additional competition."

While the localization community continues to overlook the premium segment, potential investors seem much more interested. I gathered from my research that Private Equity and Big Four accounting firms regularly approach boutique premium firms to explore potential opportunities.

What is the premium translation market?

A premium translation market segment is where the impact/cost of lackluster, literal, or inadequate translation is dramatically higher than the initial higher price paid to produce the translation product.

"Markets where the cost of failure is dramatically higher than the cost of performance." Kevin Hendzel

An admittedly dramatic example is useful to help illustrate this. The NSA has provided documentation on how translators unfamiliar with Japanese diplomat-speak may have inadvertently caused the US to proceed with the bombing of Hiroshima.

Mokusatsu (黙殺) is a Japanese word composed of two kanji characters: 黙 (moku "silence") and 殺 (satsu "killing"). It is one of the terms frequently cited to argue that problems encountered by Japanese in the sphere of international politics arise from misunderstandings or mistranslations of their language. The Japanese verb for withholding comment is mokusatsu(suru), which could be better understood culturally as, "We'll wait in silence until we can speak with wisdom."

The meaning of mokusatsu can either be "ignore/not pay attention to," or "refrain from any comment," depending on the specific circumstance and context of the usage.

The word Mokusatsu was used in a Japanese government response to the demand that Japan surrender unconditionally to Allied forces. Unfortunately, international news agencies saw fit to tell the world, that in the eyes of the Japanese government, the ultimatum was "not worthy of comment." The response was thus misunderstood to mean that Japan had rejected the terms. This misunderstanding contributed to Truman's decision to carry out the atomic bombings of Hiroshima and Nagasaki. We know today that around 150,000 people died as a result of this unfortunate action.

In the global business context, similar misunderstandings around critical terms can also happen around the reporting of financial results in international markets. The operation and use of complex products like naval ships, jet bombers, nuclear reactors, large-scale construction, and medical equipment also require expertise and experience with the subject matter at hand as well as linguistic issues.

Characteristics of Translation Market Segments

The following characterizations provide some useful clarification on some fundamental differences in these markets.

Bulk Localization: A key objective of most bulk localization projects is cost and production efficiency. Fast-flowing corporate web and product description-related content needs to be rapidly available in a large number of languages. Thus, high volumes of "good enough" quality are often a characteristic of translation here.

Value-Added: A key objective here is the efficient handling of more complex source data that requires a more sophisticated technological, domain issue-focused, or culturally adjusted production process, e.g., subtitling, multimedia data, and culturally appropriate advertising.

Premium: A key objective here is engaged, proven content expertise (SME) in addition to linguistic competence to ensure effective communication focused on high-impact content. Subject matter experts do the translation in deep engagement with the content producers. It has a much stronger focus on the communication impact of the target translations. Translators here tend to be deeply specialized in a specific domain rather than generalists who jump from subject to subject. I would characterize most of what is called "transcreation" as a value-added translation, NOT a premium translation. While financial or SME-driven transcreation is possible in the premium market, generic transcreation is probably closer to the bulk market or value-added sector at best.

I have found the writings and presentations of David Jemielity, Head of Translations at Banque Cantonale Vaudoise (BCV), particularly useful in understanding the work of translators in the premium sector. He has characterized the business translation market as a large and growing economic sector that "punches below its weight" in terms of visibility.

Here is a recent presentation where David provides much clarification on the characteristics of the premium market and his observations on value-added translation in general. This clip provides some specific samples of the finesse and expertise that is expected in the premium sector.

Most of the dismissive comments on the premium market focus

on just two aspects of the market reality, price, and specialization. Many bulk

market critics claim that they, too, have higher price segments, and have

domain specialization when needed for regulated markets like Pharma and

Finance. However, as one looks more closely at the bulk vs. premium approaches,

one sees that the differences are indeed more substantial and nuanced. A

fundamental difference that I noticed in my interactions with several premium

market service providers is the increased focus on communication rather than

translation, and the degree and level of engagement they have with their customers.

Relationship to Content Creation

Most bulk localization work tends to happen downstream, with translators having little or no say, or interaction with the content creation process. Source text is "given from somewhere" and is expected to be converted to many target languages quickly and cost-effectively. And thus, translations tend to be word-for-word and often not fit for purpose due to expediency and lack of any client contact.

Premium translation is a more collaborative, consultative, and engaged process with the content creators to ensure that content is optimally translated, which often means "no excuses effective communication" in the target text. This increased engagement is necessary to rise from "Is this a good translation?" to "Is this effective target-language communication?"

Effective communication outcomes have a higher value for all stakeholders involved than "good translation." This means that ensuring the communication intent is preserved has a higher value than ensuring all the source words are translated. In many cases, as David's experience at BCV shows, this can even mean regular interaction with the CEO and CFO around critical financial market communications. Facetime with key executive stakeholders is a characteristic of the premium segment, which also means that translators can influence the way new and future content is created once they have established themselves as trusted service providers.

Lisa Rüth, describes the buyer and seller relationship as a partnership in the premium market. "The translator is not a mere supplier, and both parties see translation as a service, not a commodity. Premium-market translators usually provide excellent service. They will often go the extra mile – and be paid for it as a partner can be expected to be."

Translator Specialization

In the bulk localization market, large LSPs often source, barely vetted translators out from "vendor" databases that may contain 150,000+ translator resumes. There is much room for problems in such an approach. Long-term focus on a limited subject domain is a necessary condition for building credible expertise, and most of these databases are focused on cost and turnaround efficiency attributes. Proven expertise capabilities are not easily embedded into these databases.

Translators in the premium market are expected to have deep subject matter expertise. SME means verifiable field-specific knowledge. Specialization means that work is limited to a specific and narrow subject domain continuously, i.e., five days a week for years, not three days a week for a month. Subject matter expertise can only be built by a sustained and long-term focus in a specialized field.

As David explains: " A [financial] translator who is truly specialized in the field will give the CEO tons of different ways to talk about this uncomfortable [financial] thing that the CEO doesn't really want to talk about (because it might send the share-price down). In brief, a truly specialized translator knows his field so well he's practically a walking thesaurus in it. The translator has harnessed high-end specialized skills, "blended" skills that combine overall verbal agility with deep knowledge of a specific field —and particularly, of its discourse. How deep? Deep enough to be impressively resourceful in a content-brainstorming session with other native speakers who work in that field. If you can do that, you've passed the specialization test." Real specialization requires that many different subject areas are permanently excluded from ongoing consideration. Financial premium market translators do not volunteer to translate virus detection diagnostic equipment related material because the money is good. Ever. Just as a top dermatologist would not agree to perform cardiac bypass surgery. Ever.

Lisa Rüth states the key characteristics of premium market translators as: "Firstly possessing excellent writing skills and knowing how to apply them to the client and the situation (think "purpose" and "target groups"). Secondly, it means possessing expertise in what you are writing about – fluent subject-matter knowledge." This expertise also means that a premium translator is more likely to use more authentic, field-specific terminology that has a desirable and favorable communication impact.

True specialization and real expertise will matter even more in this age of increasingly good automated translation. The MT will continue to improve, but we are still a considerable distance from computers that understand and can infer the communication intent and the impact of a translation. The premium market and translators who have proven subject matter expertise are likely to see little effect from better MT. However, for translators who work with bulk, low-value, short shelf-life, commodity content NMT is already producing compelling "good enough" translation in many language combinations. It is reasonable to expect that many bulk market generic (unspecialized) translators will feel the downward price pressure and displacement impact of improving MT in the future.

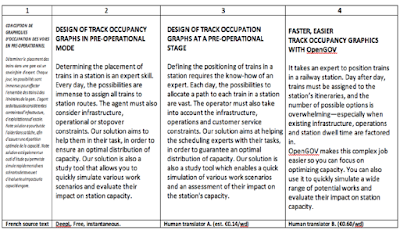

Chris Durban regularly illustrates this point through side-by-side comparisons that underscore the widely varying skills of translation suppliers. Her aim is twofold: demonstrate that demand exists for genuinely expert translators who have developed the high-level skills described by Rüth. And also point to trouble ahead for suppliers delivering work that, while usually devoid of grammatical and spelling errors, mimics source-text syntax and offers little added value on MT as shown below.

Source: Chris Durban, Table showing MT, Bulk, and Premium translation comparison.

Translation Process Modifications

Premium translation is focused on producing useful and natural communication in the target text, which means that translators are allowed and expected to ask questions about the conversation and brand intent in all high-impact source-text messaging. Translators are advising stakeholders on the best and most natural communication practices in the target language to ensure that communication is effective. This advice can involve source reconfiguration and the development of non-literal translations that are simply more effective in the target text. Of course, this cannot be done for all the documents that are translated in the modern enterprise. Thus, information triage is part of the consultative and collaboration process, and decisions are made to reserve this more engaged process for "content that really matters." This type of content will include high-impact financial market communications, operation of nuclear reactor controls, military and weapons systems, science, and technology research, critical medical care related material, cybersecurity processes, and other enterprise survival and life and death outcome related content.

Banks and other firms looking to optimize multilingual communications processes need to start by identifying [high-impact, e.g., earnings reports] image-critical content and other key texts. Then, they need to develop differentiated business processes [to handle these] as part of an overall multilingual content strategy.

David Jemielty, BCV

More Frequent and Engaged Customer/Translator Meetings

Keeping translations on message and keeping the communication intent clear in the target text is something that can only be done through in-depth engagement with content producers and stakeholders. However, as these meetings can sometimes be with C-suite executives, the translators involved need to be efficient, precise, and prepared for these interactions. Sessions are likely to be short, efficient, and focused on the perceived impact of the translation text, rather than on linguistic accuracy of the translation per se. As David summarizes, "You should fuss lovingly over the meetings in the same way that you fuss lovingly over your translations." These meetings are sometimes needed to address low-quality source text issues and ensure that the impact of the target text communication is not compromised because of this.

Again, David says it best: "The most successful firms and organizations foster a dialog-based culture of translation for their high-end, image-critical content. At the most basic level, this means that translators should ask questions because that is the only way to successfully negotiate the "incongruencies" that exist between languages (i.e., the differences in the way languages are structured and the differences in their stylistic preferences). However, a truly dialog-based culture of translation goes beyond Q&A. When it comes to translating high-end, image-critical content, "dialog" means just that: there should be an ongoing conversation between the translators and the text owners on how to best render the key phrases, terms, and ideas in each text. When the process is working correctly, each side makes concessions.

What is notable here is a willingness to sacrifice consistency among the various linguistic versions when there is a good reason for doing so, such as a marked difference in stylistic norms between the languages concerned. As the American writer, Ralph Waldo Emerson famously wrote, "A foolish consistency is the hobgoblin of small minds. "

Such processes take time, however, and not just translator time, but also text-owner time (which can be rather more expensive). Therefore, they must be employed sparingly, on the texts that count. In addition, translators must be hired and trained to perform well in such "give and take" situations."

Management of Perceived Quality – Buy-In

Another purpose of the increased buyer/translator engagement is to build and establish the reputation of the translators as experts who are aligned with the higher organizational purpose of producing effective communications across languages to further the international mission. Executive buy-in is obtained by clearly showing the benefit of a recommended communication (translation) approach and by providing ongoing examples (benchmarks) of value-add that go beyond the literal translation of the source text.

It seems that in many organizations, the premium market needs and bulk market expenditures co-exist. All content is not equivalent, and there is a role for both kinds of translation services.

Comparative Translator Culture

The culture among premium translators is much less concerned about competition, and peers are much more likely to be friendly and collegial even when they work for the same client. There is a striking contrast to the zero-sum game, high price pressure, and rapid turnaround expectation that often characterizes bulk market relationships, which are also less sticky. Clients who build trustful relationships with premium SME translators seem to want to keep these in place. Trust is not easily replaced and is earned over time, usually with long-term competence and demonstrated expertise. The presence of trust also engenders mutual respect.

Premium translators are also much less likely to be present in social media and more likely to commit to ironclad NDAs and data security requirements, which also limits the number of customer case studies that document their work.

I also noticed that premium market translators are much more willing to share examples of their work products and demonstrated competence and often have a work portfolio ready to document expertise properly.

"Subject-matter knowledge, writing skills, willingness (and ability) to ask questions—those are three skills that my segment of the market demands" says Chris Durban. She characterizes the premium market culture; thus: " Full-time translators with genuine specializations regularly point out, the premium end of the market is crying out for skilled practitioners. And based on their accounts, what's not to like? Intellectually challenging texts plus the satisfaction of giving these a voice; engaged clients eager to discuss nuance and impact; recognition—even gratitude—from demanding buyers; attractive remuneration." The premium sector is an attractive and growing market, but one that requires practitioners to master an exceptional skill set described here.

It is also unlikely that we would see many premium market participants at localization industry events. They are much more likely to focus on industry conferences that their clients focus on, or on translator events where accreditation and professional qualifications are more visible. Some examples include https://www.translateincambridge.com/en/ , https://uetf.fr/en/previous-editions.html, BDU events, and specialized events like this.

Concluding Remarks

There is indeed a premium market, probably quite substantial in size, even though it is hard to discern for those whose primary focus is the bulk localization market. This market has different professionalism and expertise requirements and has a mostly different business model. It has always been visible to us in the MT community as one end of the information triage chain. Fifteen years ago, I was surprised to discover how large it was, even for the US intelligence community, one of the most significant users of MT worldwide. Many are not aware of the fact that their spending on highly specialized human translators was fifty times higher than their spending on MT. That's a remarkable fact when we consider that the US intelligence community has always been a pioneer of AI and MT, a trend that continues today. However, they understand that MT (technology) and expert humans occupy different parts of the value chain.

The premium market is an opportunity lost and missed by the bulk localization market players whose attention is consumed by the reality of survival and competition in the bulk translation world. Most of the private equity bets in the translation market are focused on trying to make bulk more efficient and streamlined, but IMO we have yet to see any of these investments bear fruit. The fact that expert-driven professional service giants are looking around the premium market suggests that this could change.

The translation service business is built with interacting technology, business processes, expert human input, and clients with a global mission. To me, the most valuable element here has ALWAYS been expert human input. However, I have yet to see this properly reflected in the localization market, even though it seems glaringly apparent in the premium translation market. It will not surprise me if the disintermediation of the localization industry comes quietly in the night through an opening in the premium market.

An opposing opinion by Luigi Muzii on the Premium Market can be viewed here: Lead and Gold: Challenging the Premium Translation Market Claims

This is a link to a response by Kevin Hendzel to the opposing view stated in the link above: The Premium Translation Market: Come On In. The Water’s Perfect.

0 Comment